Background

Finding an online exchange where you can buy and sell crypto in Zimbabwe is impossible. There isn’t any and if there is one then it’s not popular and probably not being used by very many people. I have faced this challenge: when I try to withdraw money from my Binance account to fiat USD (real money if you want to call it that), I can not do it on Binance directly. The best available solution is to look for another person who wants crypto in Binance or finding a middleman who can take my crypto. This is not really much of an option because it opens me up to scammers.

I know I am not the only one who faces this problem, forex traders face this challenge also. For example, most brokers do not take our local “ZIPIT” Mastercard or Visa card. Those that do, because of money laundering rules, they don’t allow you to withdraw more than what you deposited. Its a dead end, imagine if you had made some good trades and profited handsomely but you can’t withdraw your gains; that’s gotta hurt. Thanks to crypto, some brokers (almost all) now accept deposits and withdrawals using Bitcoin and/or USDT (Tether).

Crypto is by far the best way to move money especially across borders. There is no central government to stop you, your transactions take minutes if not seconds to be settled and you can transact on weekends; even on holidays. This is why most forex traders use the crypto option to deposit and withdraw, its just efficient with no limits. However, we all know in Africa a very few shops are willing to accept your USDT even if it has the same value as your fiat US dollars; working on changing that. So what do you do then to make that crypto deposit? Worse, how do you get to spend your withdrawals if no supermarket can allow you to buy sugar with your crypto?

We have built a centralized stablecoin exchange that would allow you to sell or buy stablecoins starting with USDT (officially known as Tether). Instead of relying on a middleman who puts high markups and rates, why can’t you sell and buy from each other directly on a central exchange which guarantees enough liquidity. An exchange with small spreads (markups/rates) where you can buy and sell crypto at any time of the day or week because there will always be someone on the opposite side.

In this blog post I will introduce you to our exchange, RetailBets, and explain to you how the exchange allows the retail traders of Zimbabwe to buy and sell USDT. I will also explain our order book and the market maker model that guarantees buyers and sellers every minute. No banks, No middleman.

Join 1000+ users

sign up today and start to sell crypto on our exchange

Centralized exchange: A Brief explanation

There are various types of exchanges in the world that include over-the-counter exchanges (such as the ones used for Forex), decentralized exchanges (mostly used in crypto e.g. UniSwap), peer-to-peer exchanges and centralized exchanges (include stock exchanges and most crypto exchanges like Binance).

RetailBets operates as a centralized exchange meaning market participants have to place orders on one central market managed by our software. This means that users will make deposits using fiat or crypto and those funds will be held on behalf of the users by RetailBets. The users can then get to place buy and sell orders on the central market and get matched with the opposite side of their orders in which case the users will get credited either the fiat or the crypto balance depending with the order they had placed (buy or sell).

Deposits and Withdrawals

Remember RetailBets is an exchange for buying and selling fiat USD and Tether (USDT). Hence there is need to do deposit and withdrawals for both fiat and USDT. Depositing and withdrawing fiat will be done using InnBucks and the transactions typically settle instantly. To deposit or withdraw fiat, the user has to navigate to the Cash Wallet menu, shown in the following picture:

Cash Wallet menu on RetailBets

The users can get to initiate fiat deposits and withdrawals from that menu using the provided payment method (e.g. InnBucks) and following the steps recommended.

Making USDT deposits and withdrawals is done using the Abitrum One network which is Ethereum Layer-2 blockchain network. For deposit, the user is provided with an address to send their USDT to and when the transaction is complete, the user can then click the check button on the Crypto Wallet menu of RetailBets to finalize the deposit. See the following screen showing the menu, the address and the button for processing the deposit after funds are sent to the address:

Crypto Wallet menu with address and check deposit button from RetailBets

The funds from that address will be moved from that address to one of our custodial wallets and the user will be credited on their Tether balance. Please note: RetailBets uses Abitrum One blockchain network for all crypto transaction, make sure to send or receive through that network.

For crypto withdrawals, users can select the “send” tab and paste the address which they wish to withdraw their USDT to. The address can be provided by Binance, MetaMask etc.

Placing an Order

After depositing their fiat or crypto, the user can either buy crypto or sell crypto respectively. The user can do this by placing orders on the market and these orders can either be Limit orders or Market orders.

As you might know, a Market order will match the best opposite orders without respect for price. A Limit order will match the best opposite orders that are less than or more than the price for buy and sell options respectively. Limit orders guarantee price and Market orders guarantee execution. You can do further research on these types of orders to understand them better.

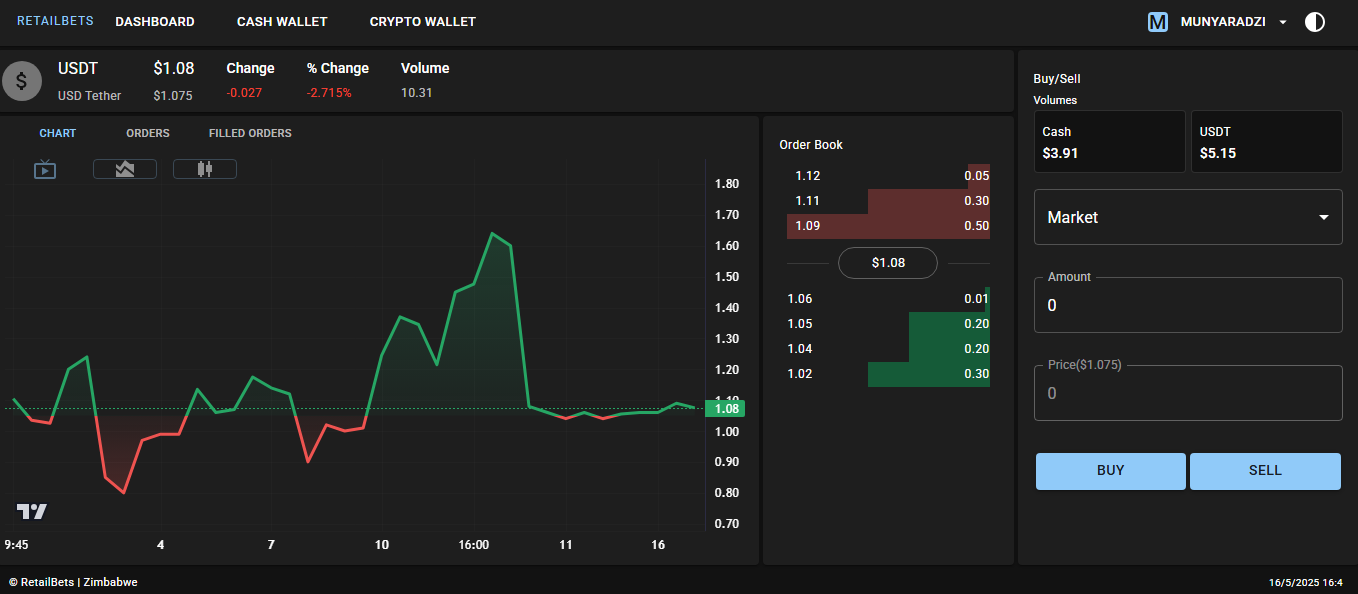

Go to the Dashboard menu to and you will be able to place your orders from there. See the following picture:

Dashboard of RetailBets

The dashboard allows you to see the mid price (average of best buy order price and best sell order price), view price movements and monitor the order book.

The order book

The order book shows you all the unmatched Limit orders within the market which a buyer or seller can match to instantly execute an exchange of fiat and crypto. It shows you all the levels of the market where there are orders and the volumes on those levels. See the following example order book:

Example Order Book on RetailBets

As you can see from the picture, there is a mid-price which is $1.08. Everything below the mid-price are open buy orders which will be matched to sell orders in the future. Everything above the mid-price are open sell orders which will be matched to buy orders in the future. Research about the order book and matching of orders to understand this more.

Successful buy or sell crypto

When an order is matched, the respective users will get their balances credited automatically. The buyer will get their crypto balance increased and their fiat balance reduced accordingly. The seller will get their fiat balance increased and their crypto balance reduced accordingly.

After this the user can get to withdraw their fiat or tether (USDT) using the process explained above.

Market Makers

For a buy order to be matched, someone has to be on the opposite side( with a sell order) and vice versa. However, it is not always the case that you have equal volumes of sell orders and buy orders. There are instances where you can just get buyers without sellers in the market or vice versa. That is a bad situation since no orders will be matched.

To solve that problem, RetailBets will use Market Makers. Market Makers are liquidity providers meaning they are always in the market and willing to buy or sell to anyone in the market at a fair price. This means that even in the midst of the night, our users can get to exchange their fiat or crypto without having to wait long times for the opposite side.

Conclusion

RetailBets is a centralized exchange that allows users in Zimbabwe to buy and sell crypto for fiat with each other. Users can deposit and withdraw their fiat using local payment methods such as InnBucks. RetailBets allows the users to place Market or Limit orders and they can monitor price from the order book to decide how they wish to participate in the market. We rely on market makers to ensure liquidity in the market.

Connect

Learn how to sell crypto and buy crypto from us

Leave a Reply